That won't budge it

Failure to invest is only ramping up Britain's frightening fiscal future

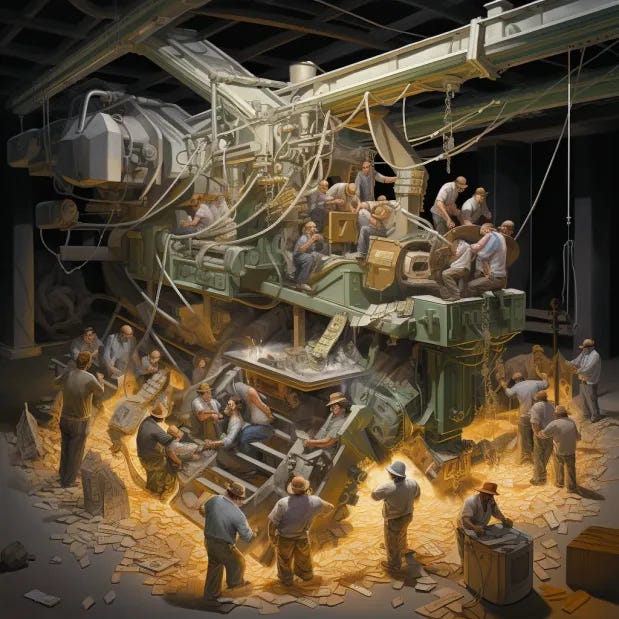

The Autumn Statement has rolled by with its usual flurry of giveaways, takeaways and takes. Yet the whole thing seems to exist in a parallel world to the realities of the British economies, the challenges to come and the strain that both public and private finances are facing. It was another fiscal event that offered routine answers and tried to dodge the big questions that are looming over Britain.

Jeremy Hunt seems to know the importance of investing. In his budget he sought to make it easier for individuals, with streamlining for moving pensions between workplaces, and for businesses, with a much called for extension of the full expensing rules. It's simple common sense – spend a bit more today, or put something away and in the future, you might have a little more. Yet such thinking has been abandoned by the state.

When Harold Macmillan spoke out to criticise the Thatcher government, he accused them of not understanding the difference between income and the proceeds of the sale of assets. Now the government seems to make the same mistake with expenditure, beggaring capital investment to cover day-to-day funding gaps.

This the Autumn Statement, the Chancellor conceded that the government's long-term investment will be frozen in cash terms, amounting to a cut once inflation has been factored in. The leeway created by the Chancellor’s newfound headroom was instead spent on short-term giveaways, in the form of the NI cut and the inevitable application of the Triple Lock. It is a recipe for future strife.